Accessing financial data has never been simpler in today’s digital world, including accessing your credit score. Wells Fargo customers have easy access to this crucial piece of data with their mobile app; here we provide instructions for checking it on Wells Fargo’s app.

Understanding the Importance of Your Credit Score

Before embarking on the process, it’s essential to grasp the significance of a credit score.

What Is a Credit Score?

A credit score is a three-digit number generated from an individual’s credit history that serves as an indication of their creditworthiness and can play an essential role in various financial scenarios, including loans, rent contracts and employment searches.

Why Is Regular Inspection Essential?

Monitor Your Credit Frequently can help in many ways; such as:

- Identification of Disparate Events: Any unexpected decline could be an indicator of fraudulent activities.

- Improving Financial Health: Acknowledging your financial health will allow for improved decisions when making future financial choices.

- Preparing for Major Purchases: Knowing your score can help determine if you’re ready to purchase large items such as a home or car.

Finding Your Credit Score with Wells Fargo App

Once you understand the significance of credit scores, the next step should be obtaining them. Here’s how the Wells Fargo app can assist with this goal.

Install and Configure the Application

Before accessing your credit score, ensure:

- Download and install the Wells Fargo app from your device’s app store, then log in using your online banking credentials; if you have not registered yet for online banking, first register.

- Unlocking Your Credit Score Feature

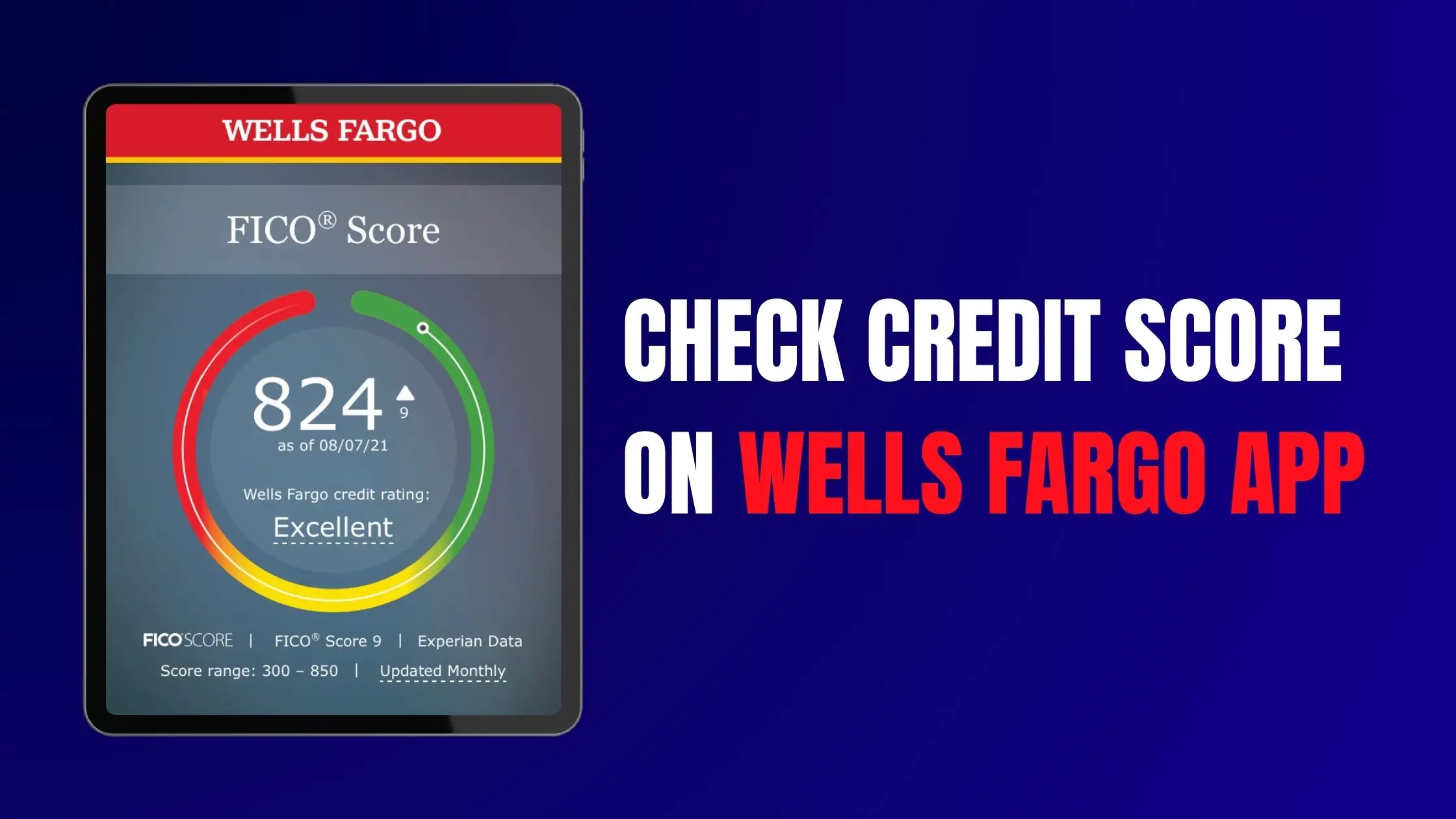

Once logged in, navigate to your “Account Summary” page and scroll down until you find an option labeled “Free Credit Score” or similar. When clicking it, you may be asked to answer security questions or provide additional authentication measures before receiving your score.

Interpret Your Score

After receiving your score, keep this in mind:

An FICO score between 300-579 is considered poor;scores between 580-669, Fair, Good and Very Good (740-799 and Excellent respectively) should all be considered acceptable. Here are some ways you can increase your credit score.

Tips to Improve Your Credit Score

If your score falls short of what’s needed, don’t get disheartened; here are a few strategies to improve it:

Always Make Payments On Time

Timely payment of bills and loans can have an incredible effect on your score, so automate them to avoid any mispayments or oversights.

Maintain a low credit utilization level

Credit utilization measures the percentage of available credit that you’re using; aim to keep it below 30%, for instance if your limit is $10,000, aim not to have balances higher than $3,000.

Avoid Unnecessary Credit Inquiries

Every time you apply for credit, a hard inquiry will be performed that could negatively affect your score. Only apply for loans when necessary!

Frequently Asked Questions (FAQs)

Wells Fargo typically updates credit scores monthly; however, depending on various factors this could vary significantly.

No, Wells Fargo offers this service without charge to its customers as part of their commitment to increasing financial literacy and empowerment.

Checking your score using our app is considered a “soft inquiry”, meaning it won’t have an adverse impact on your credit rating.

Conclusion

Knowing how to access and monitor your credit score with the Wells Fargo app gives you a powerful tool for financial health management. Regular monitoring and understanding can greatly influence financial decisions, leading to more secure future plans. So take that first step today towards knowledge.

About the Author

Bella Wright

A seasoned online content writer specializing in finance, I brings clarity to complex topics like credit cards and loans. With a passion for breaking down intricate financial jargons, I’m dedicated to empowering readers with knowledge to make informed financial decisions